China's Energy Mix, Net Zero & Production Frontiers

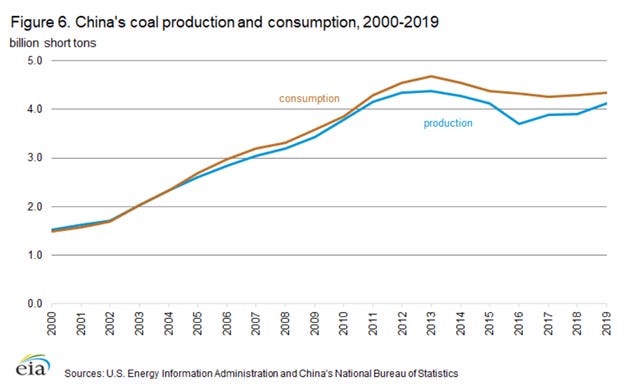

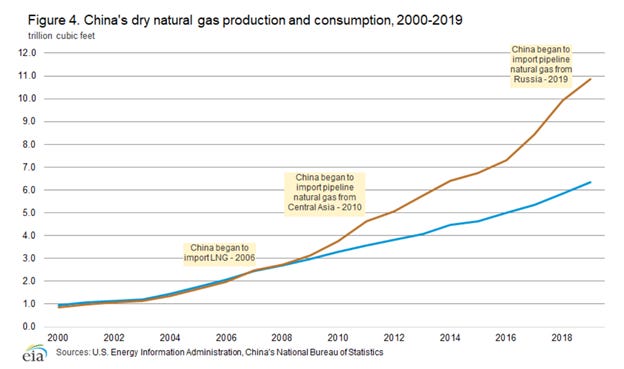

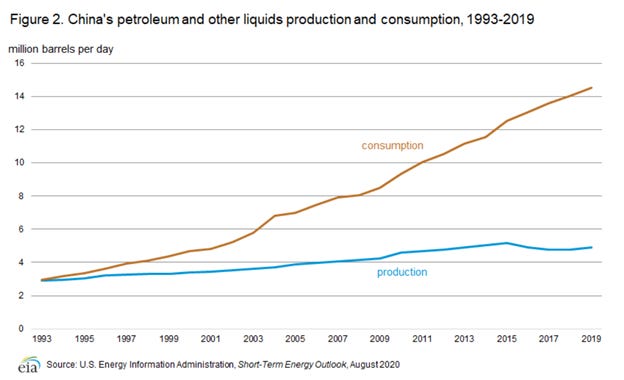

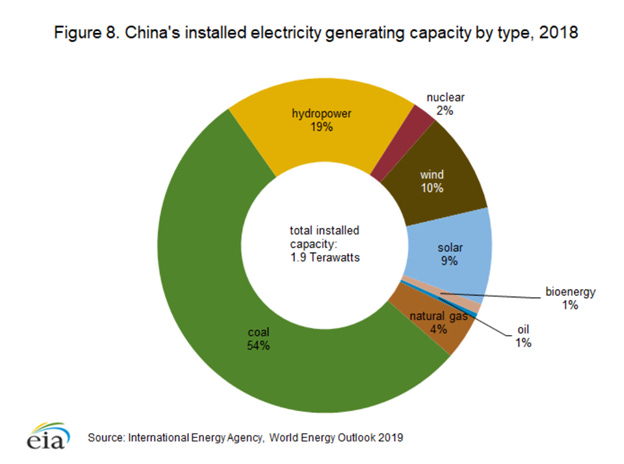

A country’s production frontier is limited by its capacity to create globally competitive outputs, making natural energy endowments a key determinant of economic potential. China’s endowment is concentrated in coal, a catalyst for the country’s industrial success. China’s increasing reliance on imported natural gas and oil is a byproduct of the country’s lack of domestic resources. In the long run, the recurring costs of imported hydrocarbons debilitates economic sustainability. The country’s lack of domestic energy alternatives incentivizes the expansion of renewable energy- not in order to avoid climate disaster, but for energy independence. China’s capital and current account surpluses facilitate beneficial conditions for increased renewable energy materials and natural gas imports.

China must identify new catalysts that enable private enterprises to respond and contribute to Government objectives. A rapid expansion of credit for renewable energy investments would provide both private enterprises and Provincial Governments opportunities to meet growth objectives and to stabilize struggling Provincial economies. The credit channel would help to shift the composition of China’s energy complex and commodity consumption. Efforts to decrease the country’s reliance on coal must combine an expansion of natural gas and green energy infrastructure. Beijing’s objectives of minimizing the country’s reliance on energy imports and restoring the economy’s vitality create fertile conditions for an expansion of renewable energy.

The current hiccup in global energy prices is partially a byproduct of China’s attempt to wean the country off coal. Since the opening of the Power of Siberia pipeline in 2019, China added the equivalent of the United Kingdom to natural gas demand. China’s pivot towards increased natural gas consumption coincided with a challenging hydrocarbon investment environment. By overlooking the old economy, global energy markets became increasingly fragile. The growing market dislocation can only partially be resolved by reopening coal mines. As a result, the world has found itself in a precarious bind between climate control and economic stability.

China’s lack of natural endowments leaves the Chinese Government and the world in the precarious position. For Western countries also reliant on natural gas imports, increases in Chinese demand put an upward pressure on prices which hinders Western countries’ production frontiers. China’s transition away from coal can only be sustained with a new energy mix which creates a continuous increase in natural gas demand. Renewable energy’s current limitations act as a hurdle to Chinese and European energy independence. Unlike Europe, China does not have natural reservoirs for storing natural gas, making the country’s future swings in demand more volatile.

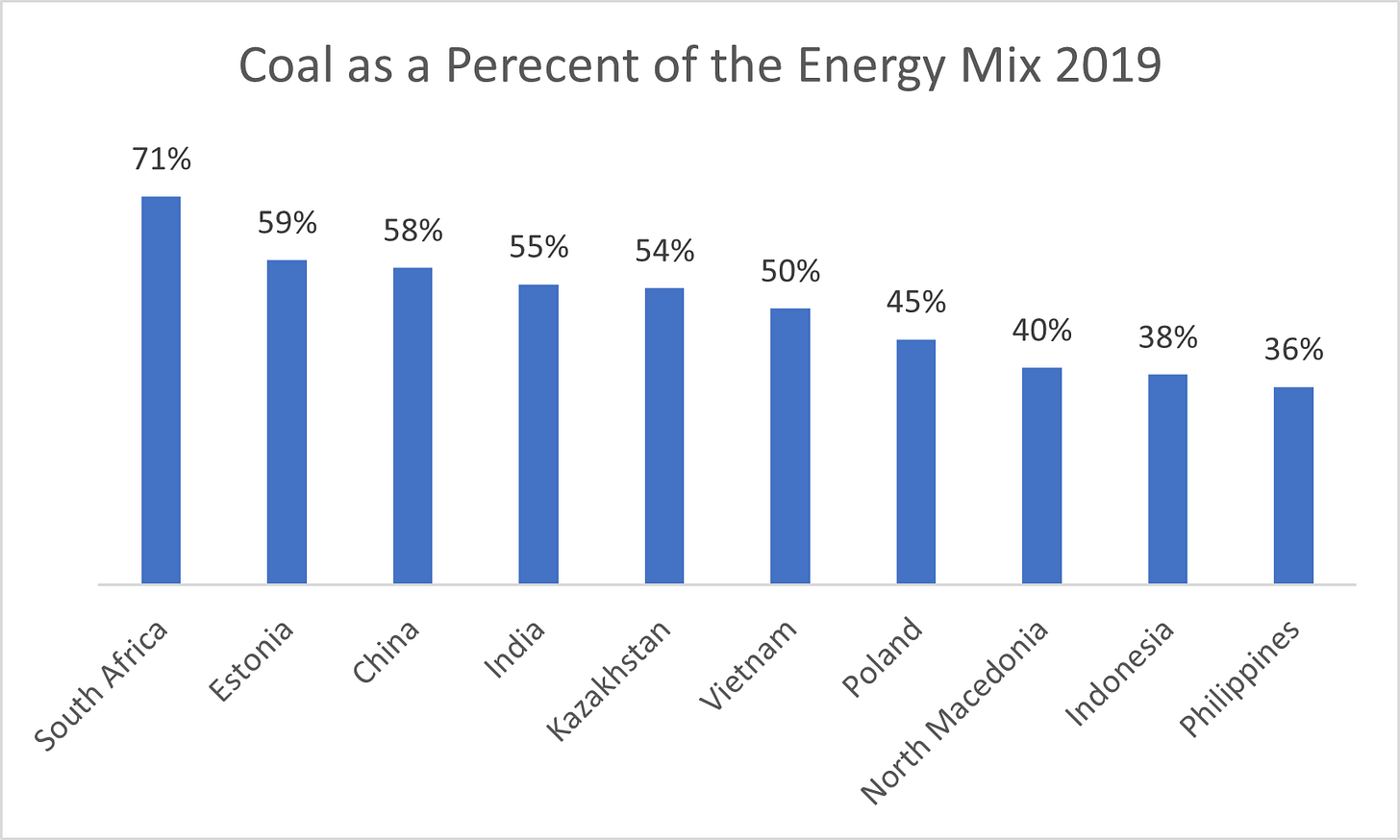

Achieving ‘Net Zero’ is complex endeavor which requires further technology innovations in renewable energy. For countries that are earlier in their development process, natural endowments will continue to act as a key determinant of economic potential. The third most reliant country on coal for its energy mix is China, followed by India. The current shocks and volatility in energy prices may become a new normal as emerging markets make attempts to shift towards low carbon energy sources. Advanced economies looking to limit the carbon emissions of emerging markets may find that a rapid shift in emerging market energy consumption composition makes a swift transition towards a sustainable future, unsustainable.