Rate Reversals, The Impossible Trinity & Capital Flows

Confronts the growing imbalance of securities flows through the connect system. Also, expands on the channels ability to alleviate pressures from current and capital account surpluses.

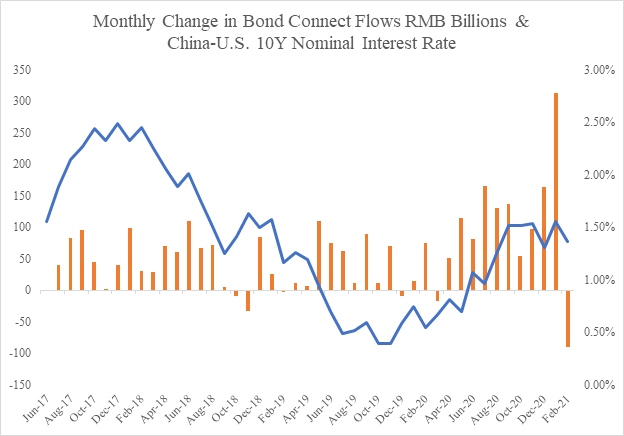

The 2017 opening of the Bond Connect created the first daily liquidity channel for foreign investors to access China’s onshore bond market. The Bond Connect’s daily liquidity served as a prerequisite condition for the inclusion of RMB denominated bonds in global benchmarks. Index inclusions generated a wave of portfolio flows into Chinese Government and Policy Bank bonds which subsequently produced an upward pressure on the RMB’s exchange rate. China’s net negative portfolio position is an increasingly apparent imbalance within China’s balance sheet. The expansion of foreign investment quotas for outbound investors will be driven by the effects of tighter monetary policies, SOE demands for competitive exchange rates and the long-term need for more transparent and effective international investment practices.

The continuous rise in urban real estate prices threatens China’s economic stability. In the short-run, price appreciation strengthens bank balance sheets and enables local governments to rely on land sales for revenues. Individual investors understand this relationship and respond by making speculative purchases on real estate, often with no intention of living in or renting out the property. Due to demographic decline and excess supply, the imbalance is unsustainable. In order to limit speculation and leverage, the Bank of China is considering raising interest rates. Tighter financial conditions create challenges for Provincial Governments searching to meet growth targets. The precarious situation makes expanding other types of production capacity an attractive prospect for meeting 2021 growth objectives.

With expectations of lower real U.S. yields in the second half of 2021, the Bank of China’s choice to tighten financial conditions becomes less economically viable. Higher relative yields attract additional RMB denominated portfolio flows. The currency appreciation associated with these purchases makes exports less competitive. This tug of war between interest rates and exchange rates is the reflective of the ‘Impossible Trinity’. A country cannot maintain free capital flows, fixed exchange rates and sovereign monetary policy simultaneously. The current conditions will force central bankers to decide between maintaining outflow limitations and beneficial terms of trade. The other option is to utilize unidentified flows or ‘Errors and Omissions’ but this statistic undermines China’s market reputation and limits the country’s future ability to internationalize the RMB.

Counter to Government aims of maintaining capital controls, China has lost $1.4 Trillion at its border, broadly defined as ‘Errors & Omissions’. Controls are constructed to limit capital mobility, but individuals continuously innovate ways to move money outside of the purview of the Government. Expanding domestic investor access to foreign capital markets is the clearest option for authorities looking to mitigate the negative effects associated with currency appreciation. The commitment to maintaining an independent monetary authority and access to China’s bond market will force the Central Government to identify new levers to ensure currency competitiveness. In the short-run Chinese entities may manage to rapidly stockpile commodities and expand BRI projects in order to recycle hard currencies back into the global economy. However, these flows do not enable to country to build a stock of liquid assets. As the stock of foreign portfolio investments becomes increasingly unbalanced, China becomes more vulnerable to capital flight. Without matching the stock assets and liabilities, portfolio replication, the RMB will experience an upward pressure which negatively impacts export competitiveness.